This post gives a general overview about Coffee in Vietnam

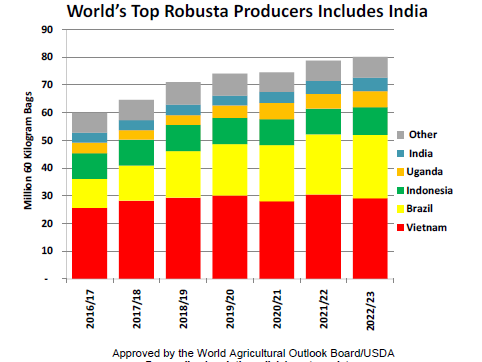

Vietnam is the world’s largest Robusta producer accounting for over 95% of Vietnam’s total output and the world’s second largest coffee producer. Rousta is cultivated in an estimated area of 620,000 ha and produced an estimated 30,480 thousand bag (60 kilogram bag) (USDA, 2022).

In the first half of marketing year 2021/2022 (MY 2021/2022), Vietnam produced an estimation of up to 31.5 million bags and exported up t0 27 million bags. The rising price of Arabica has driven up the demand for Vietnam Robusta as more Robusta is being added into roasted blends (USDA, 2022). Export to the European Union (EU) market accounted for about 40% of total export volume, in which Germany, Italy, Belgium and Spain are the major importer countries (USDA, 2023).

In the last decade despite the high production of coffee, the average rate of domestic coffee consumption was only 10% of total production (USDA, 2023). The coffee consumption rate per capita per year is 2 kg, which is relatively low in comparison to other countries (VICOFA, 2022). Most of the production served the main purpose for export.

As one of the main importers of Vietnam’s coffee, the EU plays an important role in the supply chain and has the substantial power to enforce the supply chain due diligence, thus promoting sustainability.

Approximately 171 out of 590 thousand hectares of coffee plantations in Gia Lai, Dak Lak, Lam Dong and Dak Nong Provinces in Vietnam are certified by internationally recognized sustainability certification systems and the area is expected to expand. The main certification schemes are 4C, UTZ, Fair Trade and Rainforest Alliance (Provincial Department of Agriculture and Rural Development, 2023). The coffee farmers have shifted their priority from expanding the cultivation area to sustainable, certified production and improving bean quality aiming at higher prices, thus higher income for the farmers and coping with the volatility of commodities prices (USDA, 2022).

With the adoption of the new EU Deforestation Regulation (2023/1115/EU), coffee and coffee substitutes containing coffee are listed as one of the 7 commodities, which requires it to be produced in a “deforestation-free” manner in order to be exported and sold in the EU market. There extensive due diligence should be conducted to eliminate the risk of promoting deforestation. This regulation applies to coffee, which has been cultivated since 31 December 2020. Therefore, risk assessment should be conducted to check if the cultivation of the new coffee plantations after the mentioned date causes deforestation before initiating the trade and signing the contracts. In addition, with the stricter regulation on pesticide residues of the EU at 0.1 mg/kg, coffee producers are also facing more difficulty in this regard.

USDA Foreign Agricultural Service (2022): “Coffee: World Markets and Trade”

https://apps.fas.usda.gov/psdonline/circulars/coffee.pdf

USDA Foreign Agricultural Service No. 7 (2022): “Coffee Annual”.

https://www.fas.usda.gov/data/vietnam-coffee-annual-7

USDA Foreign Agricultural Service No. 8 (2023):“Coffee Annual” https://www.fas.usda.gov/data/vietnam-coffee-annual-8

Tiếng Việt

Tiếng Việt